I wanted to write about short-selling since it’s flooding Twitter feeds and captivating the minds of every man, woman, and child around the world lately.

But it turns out, short-selling might be more about having opposing views, and those opposing views eventually being correct, rather than simply betting against an asset.

Short sellers who are wrong lose money, and nobody really cares in the long run, just one of many investors who blew themselves up on a bad bet. It’s a common theme. Short sellers who are correct make money and can become famous for their contrarian way of thinking.

Everyone Wants to Be a Contrarian

This is a much more rare feat. Everyone wants to be a “contrarian,” but you don’t become a good one unless you are proven right in your unique thinking, far after the fact.

If you want to learn about short selling or shorting markets, it’s not going to take very long before you stumble onto a name that might not sound familiar.

This is a guy who made a fortune in short-selling markets but didn’t limit himself to the practice of shorting.

He clearly understands the power of true contrarian thinking and the possible asymmetric profits by betting against the opposing crowd.

Michael Burry Does it Again

You might not recognize the name Michael Burry, but chances are you know more about him than you might think. Many people know him only by his other name, “that guy from The Big Short movie.”

He’s a licensed physician, legendary investor, and one of the most famous short-sellers in history, making enormous bets against the subprime mortgage market during the Great Financial Crisis of 2008.

If you’ve seen the movie “The Big Short,” you saw his famous bet unfold. How do you know you’re a famous investor? When Christian Bale plays you in a blockbuster hit movie, that’s how.

You don’t need to agree with everything Michael Burry says to admit that he’s one of the most captivating figures in the investing world. His outspoken social commentary lately tends to rub some people the wrong way.

Regardless of differing opinions you might have over his statements, Burry displays his ability to think critically on a wide range of topics.

And he’s completely fearless in sharing his opinions. There’s great risk in sharing deeply personal and controversial opinions on a public stage, and Burry gives absolutely ZERO – you know what.

The Big Short Squeeze

Of course, when you’re famous, sharing controversial opinions in public is a risky proposition, but it also comes with a huge payoff.

That payoff occurs when you are actually correct. Not only has Michael Burry unloaded certain contrarian thoughts in public, but many of them turned out to be correct.

Time and time again, great thinkers look to be foolish initially and dismissed as crazy, only to be vindicated at some point, far off in the future.

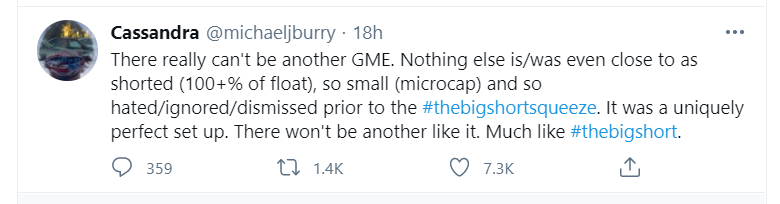

When you’re known as “that guy from The Big Short movie,” everyone wants to know the next “big short” idea. Suddenly, the GameStop story unfolds and sweeps across the world like wildfire.

Even the best and brightest investors are caught off-guard, frantically Googling news stories to learn about “share-floats” and “put-call ratios.”

Guess who’s been in the middle of the GameStop story for YEARS. That’s right, Michael Burry. And it wasn’t because of a big short. It was because of his exact opposite, opposing view. Burry had been betting AGAINST the shorts for almost two years.

In August of 2019, Burry sent a letter to the Board of Directors at GameStop, yes, THAT GameStop, ticker symbol G-M-E, the ticker we are all very familiar with by now.

What the hell was Burry doing writing a letter to the Board at GameStop? Getting ready for The Big Short, Part II? No, he was writing the letter as 3.3% owner of the company. His firm, Scion Asset Management, was a shareholder of 3 million shares of the company stock.

You can read the entire 2019 letter Burry wrote to the GameStop Board of Directors here. Obviously, the entire letter is now brilliant, considering the recent events in the share price.

Remember that Burry identified an opportunity almost two years before becoming one of the world’s biggest financial stories.

This was when GameStop stock was trading under $4 per share, and the short interest was only 63%. A relatively high figure but one that would only grow as virtually everyone assumed GameStop would go bust.

The conventional wisdom was so assured of GameStop’s demise that short interest grew to nearly 130% over the next two years.

An Opposing View, Correctly Identified

When most of the world saw GameStop as a struggling retailer, completely obliterated and left for dead by online gaming and the power of Amazon, Burry looked deeper.

He did the homework and saw an amazing opportunity with an extreme imbalance of investor pessimism. Very few others agreed, but Burry proceeded to buy 3 million shares in the company, knowing that a “hated/ignored/dismissed” idea has incredible potential power.

Burry wasn’t the only one who identified the GameStop opportunity. Still, he was one of the largest, most public figures with much reputation (and money) to lose making a bet that appeared to be foolish at the time.

This is a road that many public figures and well-known investors prefer not to travel down. Again, he gave no-F’s about appearing foolish.

He proceeded to correctly identify one of the most heavily, persistently shorted companies in history and went with the opposing, uncomfortable, ignored, and potentially embarrassing viewpoint.

Everyone Wants to be a Contrarian

Want to become a brilliant critical thinker, market master, and super-contrarian like Michael Burry? Good luck.

Taking the opposing viewpoint of a situation is easy, but you will most likely be incorrect. It’s so difficult because the crowd is not always wrong.

Some will argue, as Jeff Bezos did here, that “contrarians are usually wrong.” Remember, your unpopular, bizarre, hated, and dismissed theories must ultimately be proven correct at some point in the future.

Everyone wants to be a contrarian. In fact, I would guess that if you polled 1,000 investors, most of them would describe themselves as Contrarians. Just scroll through the Twitter bios of many investors, and you will find the self-proclaimed title “Contrarian” front and center.

The fact is, most people are not contrarians because they care too much about what people think of them.

It’s not natural to want to be unpopular, dismissed, or labeled crazy and bizarre. And much more desirable to be accepted and highly regarded among a group.

And even more difficult to identify unpopular ideas and have them turn out correct. This is what makes people like Burry so unique.

Michael Burry, Legend

Maybe you dislike Michael Burry’s political views or opinions on the handling of the pandemic. Maybe you feel that people shouldn’t be able to profit from a housing market collapse or companies going out of business.

You might disagree with the hedge fund industry making it difficult for certain companies to thrive, depending on their balance sheets’ strength.

Burry has made many investing mistakes, and not every bet has turned out as he imagined. He’s spoken out about his Tesla short, which has yet to drop. Even much of his market commentary hasn’t exactly happened as he described, at least not yet. Over the past year, he’s made remarks on the proliferation of index fund investing and their similarity to subprime CDO’s.

Something that has yet to reveal itself as a risk in markets – up to this point.

But what’s so impressive to me is someone who absolutely nailed both The Big Short and The Big Anti-Short. Two opposing strategies identified far before anyone else – by the same person. Put some respect on Dr. Michael James Burry’s name, please.

READ more about famous investors and market wizards –

Inside Renaissance Technologies Medallion Fund

Bridgewater Associates Average Return and the Man Behind the Money