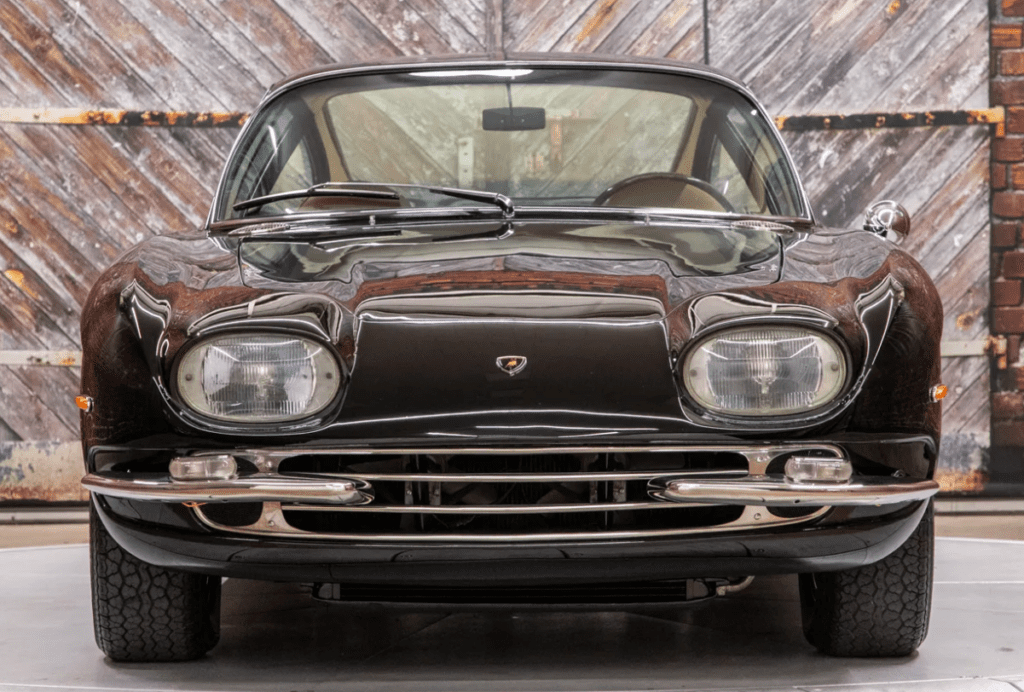

Ferruccio Lamborghini famously said, “Mechanics was in my blood.” And that statement clearly explains why he built the 1963 Lamborghini 350 GTV. As the first car he ever made, it blew away both onlookers and critics. Everyone took notice of the mechanic.

An engine designed by Giotto Bizzarrini, a body designed by Franco Scaglione, and the entire process of design and development overseen by chief engineer Gianpaolo Dallara.

The 1963 Lamborghini 350 GTV was the first Lamborghini, the prototype that would take supercars to the next level.

The Lamborghini 350 GTV

The 1963 Lamborghini 350 GTV was introduced to the public at the 1963 Turin Auto Show in Italy with both positive and negative reactions from the press.

There would someday be the Lamborghini Countach, the Diablo, the Murcielago, Aventador, and the Lamborghini Miura. All these models would redefine the supercar world. But first, they needed a prototype. The 1963 350 GTV.

Tractors to Supercars

It took Ferruccio Lamborghini only five years to go from building tractors and driving Ferraris to building a supercar prototype and famously taking on Ferrari in their own market.

Most people are aware of the fabled meeting between Ferruccio and Enzo Ferrari, which ignited a rivalry that would launch an Italian supercar brand that was determined to do things better.

Who Designed the 1963 GTV 350 Prototype?

With the engine designed by Bizzarrini, the body by Scaglione, and Gianpaolo Dallara overseeing the entire process, Lamborghini had assembled its dream team of car builders.

The goal was to build a production model supercar, but first, they needed to complete the prototype.

The very first car assembled was no production car. As they were assembling each part and piece, the team discovered the bodywork didn’t fit with the engine.

The 350 GTV featured an upscale interior by Carrozzeria Touring with upholstered leather seats and a padded leather dash.

The GTV 350 Features

Also included on the interior were armrests on the doors, chrome throughout, and a wooden steering wheel with shift knobs. Four-wheel independent suspension kept the ride smooth.

The bodywork was by Franco Scaglione, who worked at Bertone but was then self-employed.

The top speed of the Lamborghini 350 GTV was 158 mph. It featured a 3.5 liter V12 engine, amazing styling,

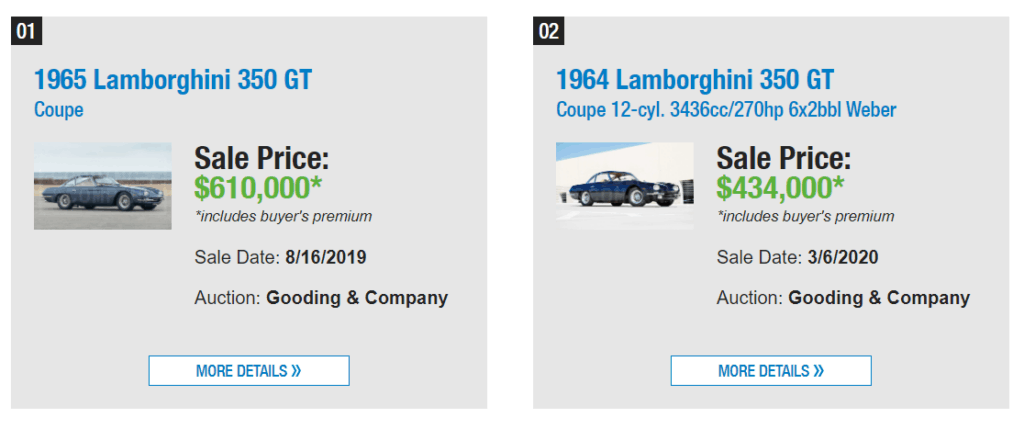

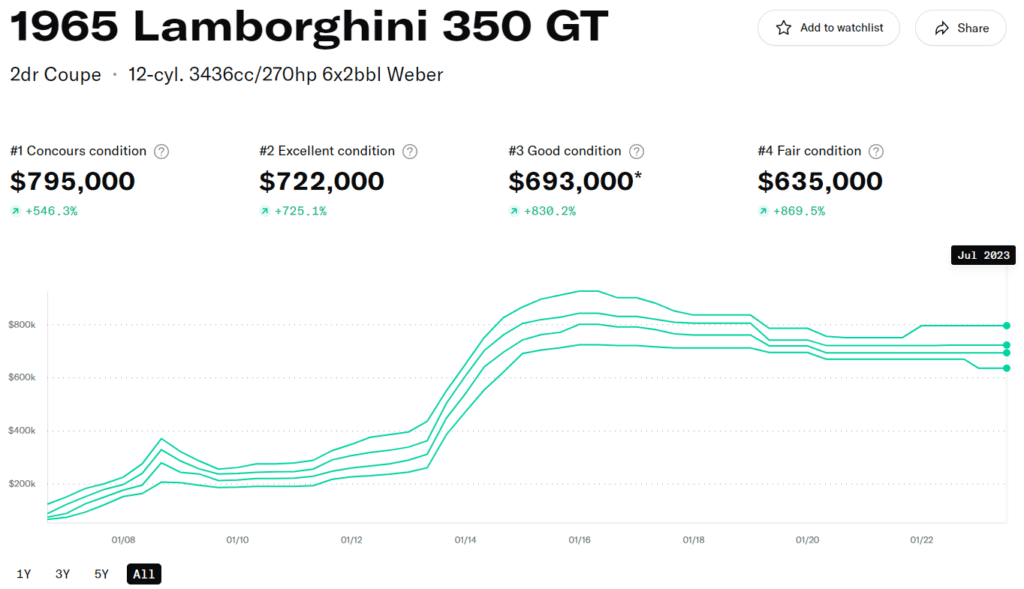

There are not many sales of the 1963 Lamborghini 350 GTV these days, so it isn’t easy to put a current value on the car. Production was limited to only 120 units.

Some experts say a 1963 GTV Lamborghini prototype could easily sell for over one million dollars today, maybe much more.

350 GTV Recent Sales

Hagerty features two recent sales of the 1964 350 GT and the 1965 350 GT. The expensive 1963 model sells rarely so it’s difficult to guess the current value of the car.

The 350 GTV featured an upscale stylish interior with upholstered leather seats and a padded leather dash. Also included on the interior were armrests on the doors, chrome throughout, and a wooden steering wheel with shift knobs.

There are not many sales of the 1963 Lamborghini 350 GTV these days, so it isn’t easy to put a current value on the vehicle. Production was limited to only 120 units.

Some experts say a collectible ’63 GTV could easily sell for over one million dollars today, maybe much more.

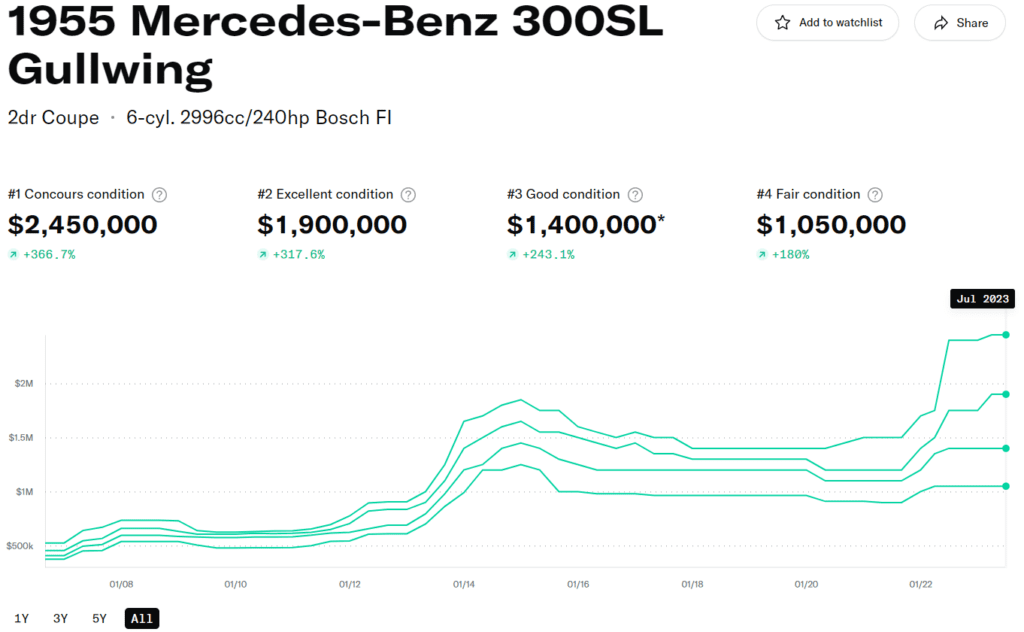

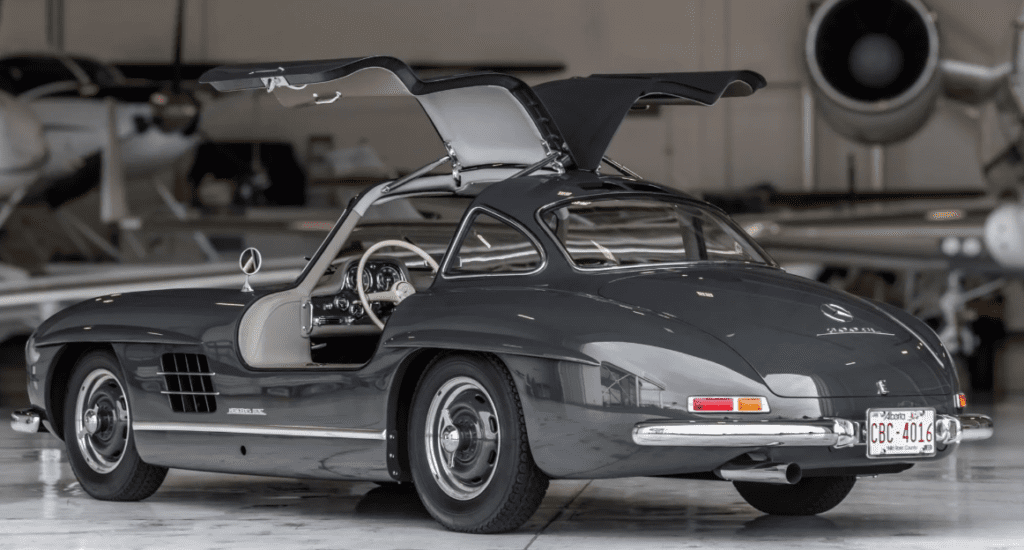

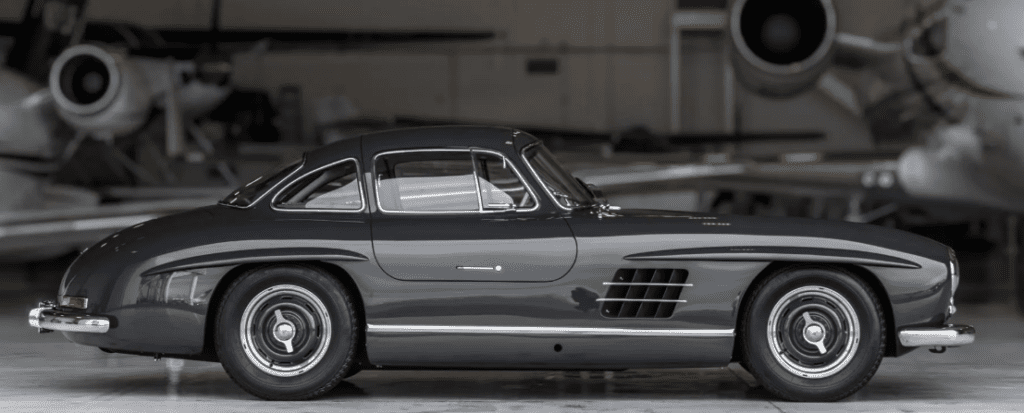

1955 Mercedes 300 SL Gullwing Coupe

The 1955 Mercedes 300 SL Gullwing Coupe was produced from 1954 to 1963 first as a coupe with gullwing doors and then later as a roadster.

They introduced the car in 1954 at the International Motor Sports Show in New York City. In 1999 the car was voted “sports car of the century.”

The SL in the name is short for “super-light.” The retail price of a new 300SL in 1955 was around $10,000, depending on the options selected.

Gullwing Coupe

Nowadays, you can find a nicely restored ’55 SL at the auction for anywhere in the range of $500,000 up to 3 or 4 million dollars.

In 2015 a 1955 Mercedes 300 SL Gullwing Coupe sold at a Sotheby’s auction for $6.5 million. Mercedes produced only 1400 of the 1955 Gullwing Coupe, making cars in top condition extremely rare.

Of the 1,400 vehicles produced, 1,100 of them went to the United States for purchase. Values over the last few months have cooled along with the overall market for collector cars. The Mercedes Gullwing has a fantastic history.

Luxury Car Importer Max Hoffman

There was a time when it was known as the fastest car in the world shortly after its release in the mid-50s. Luxury car importer Max Hoffman suggested Mercedes create a toned-down Grand Prix car tailored to affluent American car enthusiasts.

Initially, Mercedes did not plan to mass-produce the gullwing, but after the International Motor Sports Show in New York, the reviews were incredibly positive.

Just around the time of the auto show release, Hoffman placed an order for one thousand 300 SLs and began selling them in the U.S. for only about $10,000 brand new.

Jay Leno has a great video series on YouTube titled “Jay Leno’s Garage,” where he discusses his car collection. He considers the 1955 Mercedes Gullwing the most legendary Mercedes of all time.

Jay says it was the “Maclaren F1 of its day.” He also says it should be considered as one of the first-ever supercars.

The design of the car frame inhibited doors in the conventional location.

Racing rules during the 50s said a racecar required doors that opened, but they didn’t specify how they opened. The idea for the gullwing doors was introduced and proved to be a huge success.

1955 Mercedes 300SL Gullwing Values

Hagerty Market Rating Gains Slightly

The Hagerty Market Rating gains slightly from the previous month, where the collector car index registered its lowest reading since May 2012.

That’s a nearly seven-year low for the index, which tracks the current status of the collector car market.

Hagerty says even though the index is positive for the month, most of the components that make up the index are down.

The collector car valuation website shows median sale prices at auctions are now at their lowest since May 2016.

Activity in the private market is also at its lowest level in more than five years.

Recent Collector Car Sales

Another indicator that hit its lowest level since they were first included in the market rating over a decade ago is the number of mainstream and high-end car owners who think values are growing.

A recent report by Bloomberg titled, “The Classic-Car Frenzy Is Over for Skittish Collectors” recently highlighted a few of the concerns in the market. Bloomberg argued that many years of strong performance have over-saturated the market and have made it over-priced.

They report that buyers are beginning to become more discriminating with prices and high-end models.

Bloomberg cites demand for cars over $1 million collapsed at the 2019 Monterey Car Week in California recently. The sell-through ratio, which tracks the success of auctions, fell from 67% to 48% for the highest-end cars.

John Mayhead from Hagerty

Automotive journalist John Mayhead from Hagerty was quoted in the article saying prices are “settling back to what is a sensible value.”

He went on to add, “It isn’t down to the make and model anymore. It’s down to the quality of the car.” Although the Hagerty Market Rating gains slightly this month, there’s plenty of evidence the overall market is slowing throughout this year.

On the bright side, Bloomberg reports the lower end of the market is still doing relatively well. Demand for cars below $100,000 continues to boom.

This segment saw the smallest drop in the sell-through rate and was representing the most significant share of lots sold at the Monterey auction.

The HAGI Index

Another index reporting similar results for the overall market is the HAGI Index. The Historic Automobile Group International (HAGI) is another respected classic car research company with various price indexes tracking the market.

They report similar findings where prices fell over 2% in their recent October report. The HAGI Top Index, which tracks the overall demand for historical vehicles, is down 3.2% year to date.

Monthly Collector Car Data

HAGI creates indexes that track the classic car market, where they say they use “rigorous financial methodology usually associated with more traditional investments.” The indexes are published monthly in Octane magazine.

Their goal is to create transparency in the collector car sector by keeping buyers and sellers informed using ‘data-driven fundamentals.’

HAGI uses a proprietary database, including over 100,000 transactions. They collect data from four primary sources, private contacts, marque specialists, dealers, and auction results.