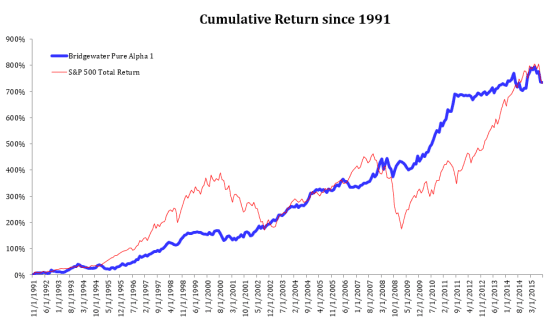

Bridgewater Associates average return over the last 28 years has been 11.5% per year. This number is important because it’s nearly double the average yearly return of the S&P 500, which is about 7%.

When you beat the market by five or six percent every year for almost three decades, you will get some attention. Bridgewater’s performance over the last three decades has been remarkable.

Bridgewater Associates

Ray Dalio has been the man behind the money. He’s grown one of the world’s largest hedge funds with over $160 billion in assets with his unique investment strategy, strategic portfolio allocations, and personal principles for success.

His radically transparent philosophy and simple steps for achieving goals have helped people around the world pursue a more meaningful purpose.

Dalio, From Zero to Billions

When you start from zero and get to the top of your industry, there are naturally going to be critics not only calling for your demise, but wishing it to come true.

With a net worth of about $19 billion, Ray Dalio has gone from country club caddy to market master.

Not only are analysts peering into the company for any cracks, bumps, or strains, but the entire financial media is searching for trading and risk management storms on the horizon.

Competition is fierce, and there’s intense pressure to attract new funds, build capital, and grow Assets Under Management (AUM).

Massive Returns

But Bridgewater seems to get treated especially critically, mostly due to its outspoken founder.

If you’re Ray Dalio, you have to be thinking at times; maybe it would be easier to let the companies performance, and Bridgewater Associates average return do the talking.

Bridgewater, Radically Unique

His company’s unique culture is sometimes debated and criticized, where he encourages “radical transparency.” Former employees complain of the atmosphere that’s been bred over the years.

Naysayers tie the underperforming years in the funds to the unconventional management structure put in place by Dalio.

Maybe if Bridgewater conformed to a more typical approach, returns would be higher, critics will argue. Once you learn more about what drives Dalio, you understand that there’s only one path to travel.

Bridgewater Associates Beginnings

Bridgewater Associates was started in 1975 by Ray Dalio, but the ideas behind the company began much earlier than that.

Born in Queens and growing up in the New York City suburb of Long Island, young Ray began finding ways to make money.

Like many kids, he had a paper route and mowed lawns for spending cash.

When he was 12 years old, he began working as a caddy at the Links Golf Club, which happened to be one of the most exclusive golf courses in the area.

Young Ray is Hooked on Markets

During the 1960s, the stock market was doing well, and the golf course was buzzing with talk about how to invest in the markets.

Conversation about bonds stock prices caught Ray’s attention. At the young age of 12, he decided to take the plunge by purchasing $300 worth of Northeast Airlines for his first stock market investment.

The stock nearly tripled in no time flat, and young Ray was hooked on the markets, asset management, and investing. The rest, as they say, is history.

Focusing on Investments

Ray wasn’t the greatest student initially, but focusing on stock market investments helped guide him through his undergrad studies.

As a fan of music and the Beatles, the biggest band at the time, he stumbled on the practice of meditation because of the band’s interest in the subject.

The Zen of Dalio

Dalio followed the band’s lead, where he began practicing Transcendental Meditation, which he credits for improving his ability to concentrate and think creatively.

In a recent interview, he credits meditation practice allowing for a clear mind and better decision-making.

Ray explains, that most people don’t realize there are two “Yous.” There’s the “emotional you” that comes from the subconscious and the “thoughtful part of you.”

Dalio and Meditation

Both have advantages, but Dalio credits Transcendental Meditation for shifting his mindset. Balancing his aggressiveness from thinking he’s always right to instead asking, “How do I know I’m right?”

Eventually, his newly formed habits and focus landed him at Harvard Business School.

Dalio says he practices Transcendental Meditation for “twenty minutes a day unless I’ve got a busy day, then I meditate forty minutes.”

The Launch of Bridgewater

In 1975, Ray launched Bridgewater Associates, and the 26-year-old was in business. He began by advising corporate clients by writing research reports on currency and interest rate risk.

Bridgewater’s first products were content, not equity shares. Before clients checked the market news, they reached for Dalio’s reports.

Bridgewater created great written research and attracted high-profile institutional investors and clients.

In 1985, Ray landed the World Bank’s employee retirement fund as a client, followed by Kodak’s retirement account soon after.

Navigating the Market Storms

Over time, anyone attempting to navigate global markets began relying on Dalio and his research. Even foreign governments and players in major markets around the world looked to Bridgewater for guidance.

Dalio quickly grew a reputation for superior research and having his finger on the pulse of markets.

With cutting-edge technology on bond yields, currency fluctuations, and emerging market trends, Dalio grew his reputation for deep data insights.

Everyone wanted to know the future of interest rates, inflation, currencies, and equities, and Dalio became a trusted source. Securities and equity traders began to dial-in Dalio before making big market bets.

Alpha and Beta, Key to Bridgewater Performance

To understand the growth of Bridgewater, we need to understand Alpha and Beta. These are terms used by hedge funds to measure and explain the performance of stock and investment funds.

Alpha is the excess return relative to a benchmark, and Beta measures volatility relative to a benchmark.

High Return, Low Risk?

To make this as simple as possible here’s what everyone wants; the highest return with the least amount of risk. Everyone wants that, doesn’t it sound great?

The hedge fund industry grew from the idea that it could deliver, or at least attempt to deliver, excessive returns with lower risk.

It’s an amazing sales pitch to anyone with money looking for a safe place to grow it.

Bridgewater Performance and Selling the Pure Alpha Dream

Let’s suppose your job is to walk into large organizations’ offices and ask them to manage their money for them.

What do you say to them? You would say something to the effect of, “I can generate higher returns for you with less risk.” Next, they would ask, “How?” You would respond with “Pure Alpha.”

Bridgewater Booms With Alpha

Pure Alpha was the fund launched by Bridgewater Associates in 1991 to grow its client base. And that’s exactly what they did.

With “Pure Alpha” and the addition of the “All Weather” fund in 1996, Bridgewater grew from $5 billion in assets under management to $38 billion by 2003.

Delivering on the Alpha Promise

Not only did they successfully pitch their management services to pensions and corporations, but they also delivered returns.

An article by Pensions & Investments Magazine in June of 2000 ranked Bridgewater the number one global bond manager for the previous five years.

Bridgewater Associates’ Average Return

Assets under management went from $38 billion to $50 billion by 2007, setting the stage for Bridgewater to show its versatility in navigating the global financial crisis.

Mr. Dalio and his team emerged from the 2009 market plunge stronger than ever, and AUM reached $100 billion by 2011.

By this time, Bridgewater was attracting lots of attention for its growth in AUM, outstanding returns, and unique company culture.

Bridgewater Vs S&P 500

An Honest Attempt to Educate and Inform

Dalio became outspoken when asked what made Bridgewater a uniquely successful company. Ray began to share his honest opinions on what he’s learned over his career, and those opinions somehow became controversial.

He argued that the biggest barrier to rational decision-making was “the ego barrier,” which was the desire to be right and prove others wrong even when the evidence was going against you.

Bridgewater’s Radical Transparency

Over the years, Dalio developed a culture of “radical transparency” inside his firm.

Now, all 1,500 Bridgewater employees are encouraged to share opinions openly. And Dalio doesn’t stop there; Bridgewater employees are also encouraged to judge the performance of co-workers.

All criticism of co-workers is encouraged as long as it leads to learning and growth. By making a list of grievances, giving feedback, or sharing positive thoughts, it’s all the same path to improvement.

Building a World-Class Culture at Bridgewater

That being said, employees who can adjust to the Bridgewater culture find themselves at the center of the hedge fund universe.

The Westport, Connecticut-based firm has grown a reputation for having “intellectual Navy SEALs” as employees.

Challenging the Best and Brightest

Certainly, the culture is not for everyone, but many aspiring hedge fund managers find it appealing, knowing the rigorous environment will make them better performers.

Dalio outlines his goal to build a competitive advantage at Bridgewater. He sees his edge in his pioneering workplace culture.

Dalio believes that truthful and transparent communication allows the best ideas to win out. His efforts at Bridgewater focus on creating meaningful work and meaningful relationships for his team.

Dalio’s Radical Truth

Bridgewater is a unique place focusing on radical truth and personal growth. Enormous success always brings out critics, but it’s difficult to argue Dalio’s approach hasn’t paid dividends over the years.

For a company that began publishing research to clients before it managed their money, Dalio has practiced what he preached at Bridgewater.

He shares an enormous amount of information and ideas about the global economy, management, and finance.

‘Understanding What is Going On’

During the financial crisis, Dalio published an essay titled “A Template for Understanding What Is Going On,” where he explained his take on the global economy’s current deleveraging process.

His take was correct; the Pure Alpha fund gained 9.5% while other funds were hit with enormous losses.

Navigating Market Turbulence

In 2010, the Pure Alpha fund gained an incredible 45%, an astounding $15 billion gain for the massive fund. 2011 saw another year of success where the Pure Alpha fund gained 23%, while the average returns for other hedge funds were negative 4%.

Ray Dalio and his Bridgewater Associates’ average return on the Pure Alpha fund has been about 12% since its existence.

Its All Weather fund has returned 7.8% since its inception and positive returns in every one of the last 18 years.

Hedge Fund Titan

Currently, Bridgewater manages more than $160 billion in assets for about 300 clients, including central banks, university endowments, and public and corporate pension funds.

Along with Co-Chief Investment Officer Bob Prince and Greg Jensen, Dalio continues to manage the company’s investment process and develop all aspects of Bridgewater’s client strategies.

Through economic analysis, innovation, and quantitative strategies, Bridgewater is not just one of the biggest, but also one of the best to ever manage alternative investments.

Pain Plus Reflection Equals Progress

Ray Dalio has been generous in giving his money and his opinions over the years. He’s crafted videos on how he believes the economy works to help people understand how to manage their own financial situations best.

He often gives interviews, sharing details of the culture inside the company he founded.

Promotion or Sincerity?

Some will say this is all in the name of self-promotion and ego-driven publicity for Bridgewater. But I’d like to believe he’s sincere in his efforts to educate, share, and inform.

When you have a net worth of almost $19 billion like Ray Dalio, you really don’t have to do anything you don’t want to do.

You could choose to live a private life and not comment on the current social challenges we face.

Dalio Continues Tackling the Biggest Problems

But running the world’s largest hedge fund doesn’t always allow silence. Dalio continues to weigh in on several important issues; he’s outspoken about many social issues like rapidly growing wealth inequality.

He openly discusses the importance of commitment to bettering yourself and your circumstances. He calls his formula for success in one of his favorite quotes: “Pain plus reflection equals progress.”

Self-Improvement, Difficult Conversations

He goes on to explain that our most painful moments are also the most important.

Instead of running away from the pain, we need to identify it and learn how to use it to improve ourselves.

Some people call them “difficult conversations,” others would say, “face your fear.” Dalio identifies the biggest challenges we face as a society and his opinions on what to do about them.

Ray Dalio’s Formula for Growth

Dalio shares another formula for personal growth and improvement.

He defines the cycle of success and upward growth this way:

- Setting and moving toward audacious goals

- Failure

- Learning principles

- Improving

- Setting and moving toward more audacious goals

Controversy follows anyone reaching billionaire status. Becoming a billionaire investment guru doesn’t come without plenty of criticism and skepticism.

And according to his own principles, I’m sure Dalio welcomes the feedback. (most of it, anyway)

Helping and Sharing

But I like to focus on this one simple fact. Ray Dalio developed a personal operating system that’s proven enormously helpful in pursuing his personal goals.

He didn’t stop there; Dalio continued to refine, examine, and share his system with the world, hoping for others to find value. It’s a commendable effort that’s much appreciated by those with questions and constant search for guidance and wisdom.

The Bridgewater Co-CEOs

As unique as the approach has been by Ray Dalio to tackle markets and hunt for outsized Bridgewater performance, it’s been an equally unique approach to running the operations of the firm he founded.

Dalio is mixing things up at Bridgewater, opting for two chiefs rather than one, and naming Co-CEOs. He named Mark Bertolini and Nir Bar Dea to share the top spot at the world’s largest hedge fund after David McCormick stepped down.

With over $150 billion in assets under management, Dalio begins a new partnership with his Co-CEOs, and turns over control of the company he founded in his apartment in 1975.

How to Invest in a Bridgewater Flagship Fund

You can’t simply invest in the Bridgewater Pure Alpha hedge fund, first, you need to be an accredited investor.

This means you need to meet certain qualifications for net worth, income, and other standards.

Accredited Investors Only

Once Bridgewater determines you meet the qualifications as an accredited investor, you can become a Bridgewater investing client.

Overall, Bridgewater’s hedge fund invests in hundreds of public company stocks and market ETFs. They keep investing strategies private, but Bridgewater releases certain holding information, such as top 10 stock holdings making up 34% of the fund’s value.

What Does Dalio Do Now?

After building one of the world’s largest hedge funds, and then turning over his leadership position, what does he do now?

Bridgewater says Dalio is still a “meaningful” owner of the hedge fund, although he’s no longer one of the three co-chief investment officers. His new title will be chief investment officer mentor.

So who is really in control of Bridgewater Associates? Now it’s in the hands of the operating board. Bridgewater’s operating board of directors has 12 members, and one of those members is Dalio.

Ray posted a tweet not long after making his transition saying, “Hopefully until I die, I will continue to be a mentor, investor, and board member at Bridgewater…”