Top 10 Most Valuable Cars of All Time

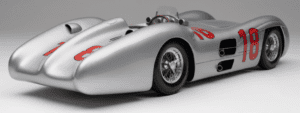

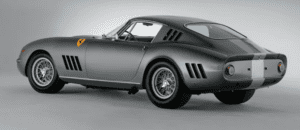

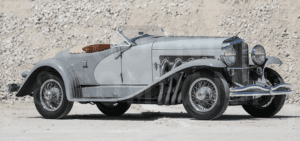

35 Most Expensive Collector Cars Ever Sold

What is the most expensive car ever sold at auction? Ferrari dominates the list, but Mercedes, Aston Martin, Jaguar, and Alfa Romeo are also included in the most valuable and expensive cars to ever sell. What about modern-day supercars? They can reach…

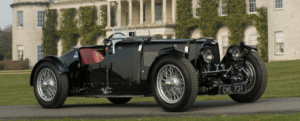

Top 10 Most Valuable Aston Martin Cars

The Magnum PI Ferrari Might be the Most Iconic Ferrari of All Time

The Magnum PI Ferrari is possibly one of the coolest Ferrari models ever made. It’s not the most expensive. It’s not the fastest. But it was driven by one of the coolest characters to ever star in a T.V. series. For nearly eight years, Tom Selleck, as the private investigator Thomas…

LEARN MORE –> The Magnum PI Ferrari Might be the Most Iconic Ferrari of All Time

Ferrari Dino 246 GTS Found Buried in Backyard (Did the Car Start Up?)

The case of the missing Ferrari Dino 246 GTS was solved, finally. You wouldn’t believe where the luxury sports car ended up. The staff writer for the Los…

LEARN MORE –> Ferrari Dino 246 GTS Found Buried in Backyard (Did the Car Start Up?)

Vintage Porsche Values Continue to Rise (Top 10 Most Valuable Rigs)

Even a slowing collector car market can’t keep vintage Porsche values down. The brand remains one of the best options for car collectors who appreciate steadiness in a…

LEARN MORE –> Vintage Porsche Values Continue to Rise (Top 10 Most Valuable Rigs)

Keanu Reeves Enjoys the Ride – From Blockbusters to Bikes

Is Keanu Reeves perfect? Well, I’m sure he has a few faults, but I wouldn’t be able to name anything specific. He’s not only one of the biggest…

LEARN MORE –> Keanu Reeves Enjoys the Ride – From Blockbusters to Bikes

The Jeep Comanche is the Perfect Truck – Prove Me Wrong

From the American Motors Corporation, to Chrysler, the Jeep brand is alive and well. After all these years, the rugged rig continues to delight collectors with it’s simple…

LEARN MORE –> The Jeep Comanche is the Perfect Truck – Prove Me Wrong

Lamborghini Reventon – Raging Bull and a Timeless Supercar

Why do collectors love the Lamborghini Reventon? The supercar captures everything great about the amazing brand. Head-turning design, heart-pounding performance, and a non-stop quest for greatness. Ferruccio Lamborghini…

LEARN MORE –> Lamborghini Reventon – Raging Bull and a Timeless Supercar

The Ford Galaxie 1960s Space Race (And the Chevy Rivalry)

It’s hard to describe what it’s like to drive a Ford Galaxie. The full-sized highway cruiser with 400-plus horsepower is described by Motor Trend Magazine as, “Truly a…

LEARN MORE –> The Ford Galaxie 1960s Space Race (And the Chevy Rivalry)

Starting Lambo – The Insane 1963 Lamborghini 350 GTV (And a Few Other Epic Rigs)

Ferruccio Lamborghini famously said, “Mechanics was in my blood.” And that statement clearly explains why he built the 1963 Lamborghini 350 GTV. As the first car he ever…

LEARN MORE –> Starting Lambo – The Insane 1963 Lamborghini 350 GTV (And a Few Other Epic Rigs)

Buick Skylark is Classic American Culture on Wheels

Back in the early 1950s, Buick ran an advertisement for their new Skylark. They described it as, “This thing of exquisite grace, Buick’s stunning new luxury sports car.”…

LEARN MORE –> Buick Skylark is Classic American Culture on Wheels

The First G Wagon – Complete History of the Epic Mercedes Rig

I love the description of the Mercedes G Wagon by Car and Driver Magazine. The rig, “Blends paramilitary styling with lavish interior appointments and a rowdy turbocharged V-8.”…

LEARN MORE –> The First G Wagon – Complete History of the Epic Mercedes Rig

Unleashing the Lamborghini Countach in 1974 (Start of the Raging Bull)

From start to finish, the Lamborghini Countach was molded by the greatest car designers to ever walk the earth. The first concept was born from auto legend Marcello…

LEARN MORE –> Unleashing the Lamborghini Countach in 1974 (Start of the Raging Bull)

Behind the Lamborghini Ferrari Feud (The Unbelievable True Story)

As Enzo Ferrari once said, “the client is not always right.” He certainly felt this way when Ferruccio Lamborghini challenged that his clutch was inferior. Luckily for all…

LEARN MORE –> Behind the Lamborghini Ferrari Feud (The Unbelievable True Story)

The AMC Javelin, A Look Back at All American Muscle

Hagerty car valuation editor Andrew Newton was quoted that AMC Javelin prices are, “holding steady like they have for years.” The epic American muscle car has been a…

LEARN MORE –> The AMC Javelin, A Look Back at All American Muscle

The Ultimate 1970s Porsche 911 Breakdown – Driving at It’s Finest

Why do car collectors go crazy for 1970s Porsche 911s? Jerry Seinfeld simply says, “This little car is the essence of sports car perfection.” If you don’t trust…

LEARN MORE –> The Ultimate 1970s Porsche 911 Breakdown – Driving at It’s Finest

Best and Worst Car Investments (Updated 2024)

As the collector car market cools off, the best and worst car investments are evolving. Car and Driver Magazine now rate the 1989 Porsche 944 Turbo, and the…

How Much is Jay Leno’s Car Collection Worth?

At last count, Jay owns 286 vehicles in his collection. How much is Jay Leno’s car collection worth? Over $50 million. And yes, he still does much of…

The 4Runner Vs Land Cruiser Collector Debate (Complete Guide)

Of all the great vehicles Toyota has built over the years, the debate between 4Runner Vs Land Cruiser is one of the most intriguing. Road enthusiasts know Toyota…

LEARN MORE –> The 4Runner Vs Land Cruiser Collector Debate (Complete Guide)